Recently, the Saudi Public Investment Fund (PIF) has attracted widespread attention with a series of actions since its arrival in China.

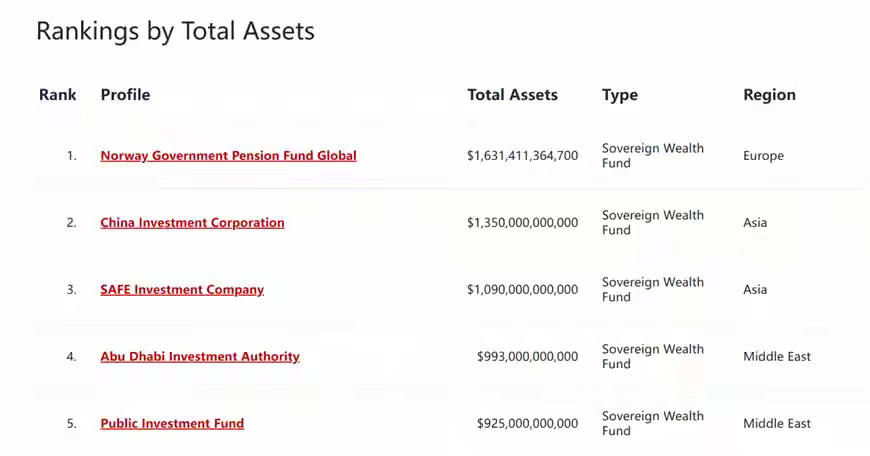

According to data from the Sovereign Wealth Fund Institute (SWFI), the latest total asset management scale of the Saudi Public Investment Fund is US$925 billion, making it the fifth largest sovereign wealth fund in the world, and this figure has been growing rapidly.

At the end of last year, the head of the Saudi Public Investment Fund publicly revealed that the agency plans to set up an office in China. The latest news shows that the Beijing office that PIF is preparing is expected to be established at the end of 2024 or the beginning of 2025.

Abdulmajeed Alhagbani, head of Middle East and North Africa securities investment at the Saudi Public Investment Fund, said in a recent public interview that the agency’s current investment in China has reached US$22 billion, or about RMB 160 billion, focusing on sustainable development, technology, automobiles, health care and other fields. The active actions of PIF are a microcosm of the continuous increase and extensive layout of Middle Eastern capital in China.

Saudi Public Investment Fund, whirlwind visit to China

Recently, the Saudi Public Investment Fund has made frequent moves and met with many Chinese senior officials.

On July 9, He Lifeng, member of the Political Bureau of the CPC Central Committee and Vice Premier of the State Council, met with Rumeyan, head of Saudi Arabia’s economic cooperation affairs with China, president of the Saudi Public Investment Fund and chairman of Saudi Aramco, at the Diaoyutai State Guesthouse on the 9th. He Lifeng said that China and Saudi Arabia should jointly implement the important consensus of the leaders of the two countries, strengthen the docking of development strategies, deepen cooperation in energy, trade, investment, finance and other fields, expand cooperation in emerging fields such as clean energy and high technology, and promote greater development of the China-Saudi Arabia comprehensive strategic partnership. Rumeyan said that Saudi Arabia will strengthen economic cooperation with China, continuously expand new areas of cooperation, and achieve greater mutual benefit and win-win results.

On the same day, Beijing Mayor Yin Yong also met with Rumeyan.

On July 10, Liu Jianchao, Minister of the International Department of the CPC Central Committee, met with Thai Foreign Minister Marri and Saudi Public Investment Fund President Rumeyan in Beijing respectively, and exchanged views on strengthening strategic communication and deepening practical cooperation in various fields.

On the same day, Wu Qing, Chairman of the China Securities Regulatory Commission, also met with Rumeyan in Beijing, and the two sides exchanged views on issues such as China-Saudi bilateral relations and capital market cooperation.

On July 11, Wang Wentao, Minister of Commerce, held talks with Rumeyan, and the two sides exchanged in-depth views on China-Saudi economic and trade cooperation.

In addition, according to the official website of China Investment Corporation, the company’s chairman Peng Chun also met with Rumeyan recently, and the two sides mainly exchanged views on issues such as China-Saudi economic and trade relations, Saudi investment opportunities, and cooperation in multiple fields between the two sides.

Just recently, the Saudi Public Investment Fund also signed a strategic cooperation agreement with the Bank of China, and signed a memorandum of cooperation with China Construction Bank and Industrial and Commercial Bank of China, etc. The two sides will deepen cooperation in the field of financial services.

PIF has significantly increased its overseas investment and publicly stated that “China is an important strategic market”

As one of the most important institutional investors in Saudi Arabia, the Saudi Public Investment Fund has been actively increasing its overseas investment in recent years.

According to a report released by the data platform Global Sovereign Wealth Fund (Global SWF), although most sovereign wealth funds in the world reduced their spending in 2023, the total transaction activity of the Saudi Public Investment Fund increased from US$20.7 billion in 2022 to US$31.6 billion in 2023, surpassing the Singapore Government Investment Corporation in one fell swoop to become the world’s most active sovereign wealth fund.

The report said that PIF completed a number of overseas investments in 2023, including the acquisition of US game company Scopely for US$4.9 billion through its subsidiary Savvy Games Group in April, the acquisition of Standard Chartered Bank’s aircraft leasing department by its aircraft lessor AviLease for US$3.6 billion in August, and the agreement to acquire Hadeed Steel Company under Saudi Basic Industries Corporation (SABIC) for US$3.3 billion in September. All signs indicate that Saudi Arabia hopes to achieve its “Vision 2030” through frequent overseas investments.

According to data from the Sovereign Wealth Fund Institute (SWFI), the latest total asset management scale of the Saudi Public Investment Fund is US$925 billion, making it the fifth largest sovereign wealth fund in the world. According to Global SWF’s forecast, by 2030, the assets managed by the Saudi Public Investment Fund will reach US$2 trillion, and its ranking among global sovereign wealth institutions will also jump to second place.

In the Chinese market, the Saudi Public Investment Fund has also been increasing its investment in recent years.

In a recent public interview, Abdulmajeed Alhagbani said that China is an important strategic market for PIF and one of the keys to PIF’s broader investment strategy. PIF hopes to invest in China and raise funds from China. Saudi Arabia’s “Vision 2030” and China’s “Belt and Road” initiative have many overlaps. Last year, the “Belt and Road” initiative ushered in its tenth anniversary. Over the past 10 years, Saudi Arabia has witnessed the implementation of this initiative.

He also introduced that as of now, PIF’s investment in China has reached US$22 billion, or about RMB 160 billion, focusing on sustainable development, technology, automobiles, health care and other fields. Key investment projects include the acquisition of 10% equity of Rongsheng Petrochemical for RMB 24.6 billion, signing a cooperation framework agreement with Dongfang Shenghong, and promoting the acquisition of 10% strategic equity of Jiangsu Shenghong Petrochemical Group Co., Ltd., a wholly-owned subsidiary.

In addition, at the end of last year, the head of the Saudi Public Investment Fund publicly revealed plans to add an office in mainland China. The latest news shows that the agency is preparing to set up an office in Beijing in the fourth quarter of this year or the first quarter of next year.

The Saudi Public Investment Fund’s positive views and actions on the Chinese market are a microcosm of the Middle East capital’s increasing and extensive layout in China.

Just in early June, there was market news that the Qatar Sovereign Wealth Fund had agreed to purchase 10% of the shares of China Asset Management, China’s second largest public fund company, from Primavera Capital. At that time, a reporter from the Economic Daily learned from an informed source that the news was true and was currently entering the approval process. All parties to the transaction hoped that it would proceed in a low-key and stable manner.

Just half a month later, the website of the China Securities Regulatory Commission showed that China Asset Management’s application to change shareholders holding more than 5% of the shares had received feedback. According to the latest feedback, China Asset Management’s proposed shareholders need to provide additional materials on the audited financial situation in 2023 and an explanation of the “financial asset management business scale, income, profit, market share and other indicators in the past three years”.

In addition to directly investing in financial institutions, Middle Eastern capital has a long history of direct investment in China’s primary and secondary markets. According to the latest list of qualified foreign investors of the China Securities Regulatory Commission, there are currently 11 Middle Eastern institutions with QFII qualifications in my country, of which two have only obtained QFII licenses this year.

Among these institutions, the most active are undoubtedly the Abu Dhabi Investment Authority and the Kuwait Investment Authority. The former obtained QFII qualifications at the end of 2008 and was the first approved Middle Eastern sovereign wealth fund, while the latter obtained QFII qualifications in 2011.

From the perspective of holdings, as of the end of the first quarter of this year, the Abu Dhabi Investment Authority’s highest-valued holding was Zijin Mining, which held 145 million shares and had a holding value of 2.435 billion yuan, ranking ninth among the company’s circulating shareholders. In addition, the top ten stocks held by the Abu Dhabi Investment Authority also include Wanhua Chemical, BOE, Haida Group, Hengli Hydraulics, Xingyu Shares, Kelun Pharmaceutical, Jinchengxin, Tonghua Dongbao, Hongfa Shares, etc.

During the same period, the top ten stocks with the highest market value held by the Kuwait Investment Authority were Chenguang Shares, Hengli Hydraulics, Satellite Chemicals, Beitani, Maxwell Shares, Xinji Energy, Zhonggu Logistics, Angel Yeast, Shenzhen South Circuit, China National Heavy Duty Truck Group, etc.

From the perspective of the heavily invested industries, some similarities can also be seen, such as new energy, intelligent manufacturing, digital economy, biomedicine and other fields, which are in line with the key investment directions of Middle Eastern capital in China.

On the other hand, it is not just the Middle Eastern tycoons who are “buying, buying and buying” in China, but also the domestic investment in the Middle East is deepening.

In the primary market, more than one well-known domestic VC has opened offices in the Middle East since last year, with the aim of assisting Chinese companies to land and expand their businesses in the Middle East, so as to promote the cooperation between domestic and Middle Eastern companies. In the field of public funds, the first two ETFs invested in the Saudi Arabian market in China in June this year – Huatai-PineBridge Southern East England Saudi Arabia ETF (QDII) and Southern Fund Southern East England Saudi Arabia ETF (QDII) were approved and will be listed on the Shanghai Stock Exchange and Shenzhen Stock Exchange respectively on July 16. This two-way rush is still going on.